I began my career as a Financial Analyst at a boutique business consulting firm, where I honed my skills in market entry strategy, distribution/channel strategy, and competitive intelligence. Working closely with mid-senior level executives at mid-large enterprises, I helped them achieve their strategic objectives. As an active member of the firm’s value investing club, I conducted equity research for the firm’s online portal.

Later, I founded AlphaValley, helping early-stage startups with compelling business plans, investor presentations, and providing investment research services for PE/VC and investment management firms.

Over a decade, my investment journey evolved to focus on resilient businesses with strong competitive advantages and long growth runways in less-disruptive industries. With Bodh Capital, I aim to help my clients build wealth through sensible investing.

Education: PGCPIB IIM Indore, MBA Finance Mumbai University

Bodh Capital is committed to practice sensible investing.

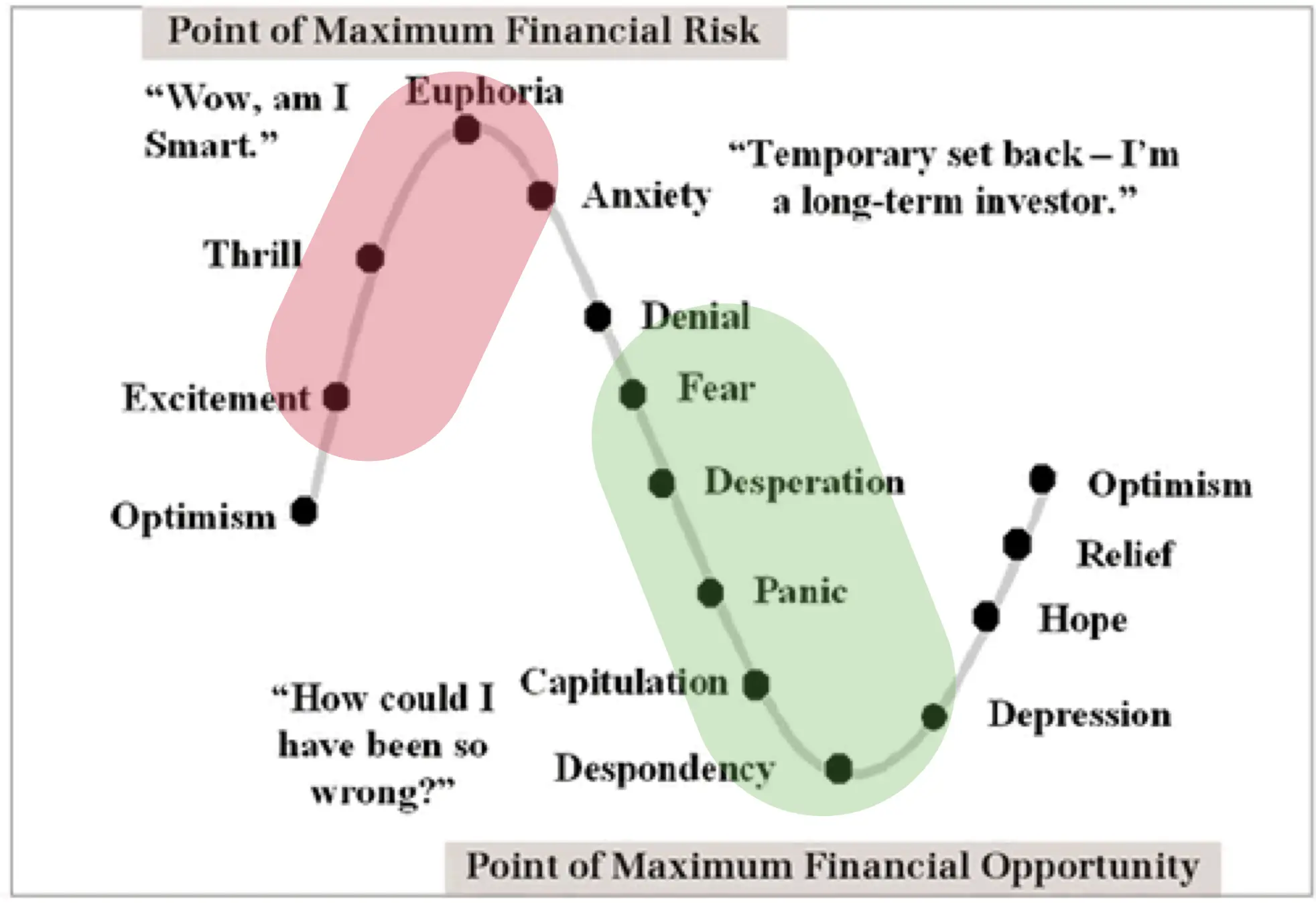

Awareness of the pendulum

Musing on sensible investing and risk

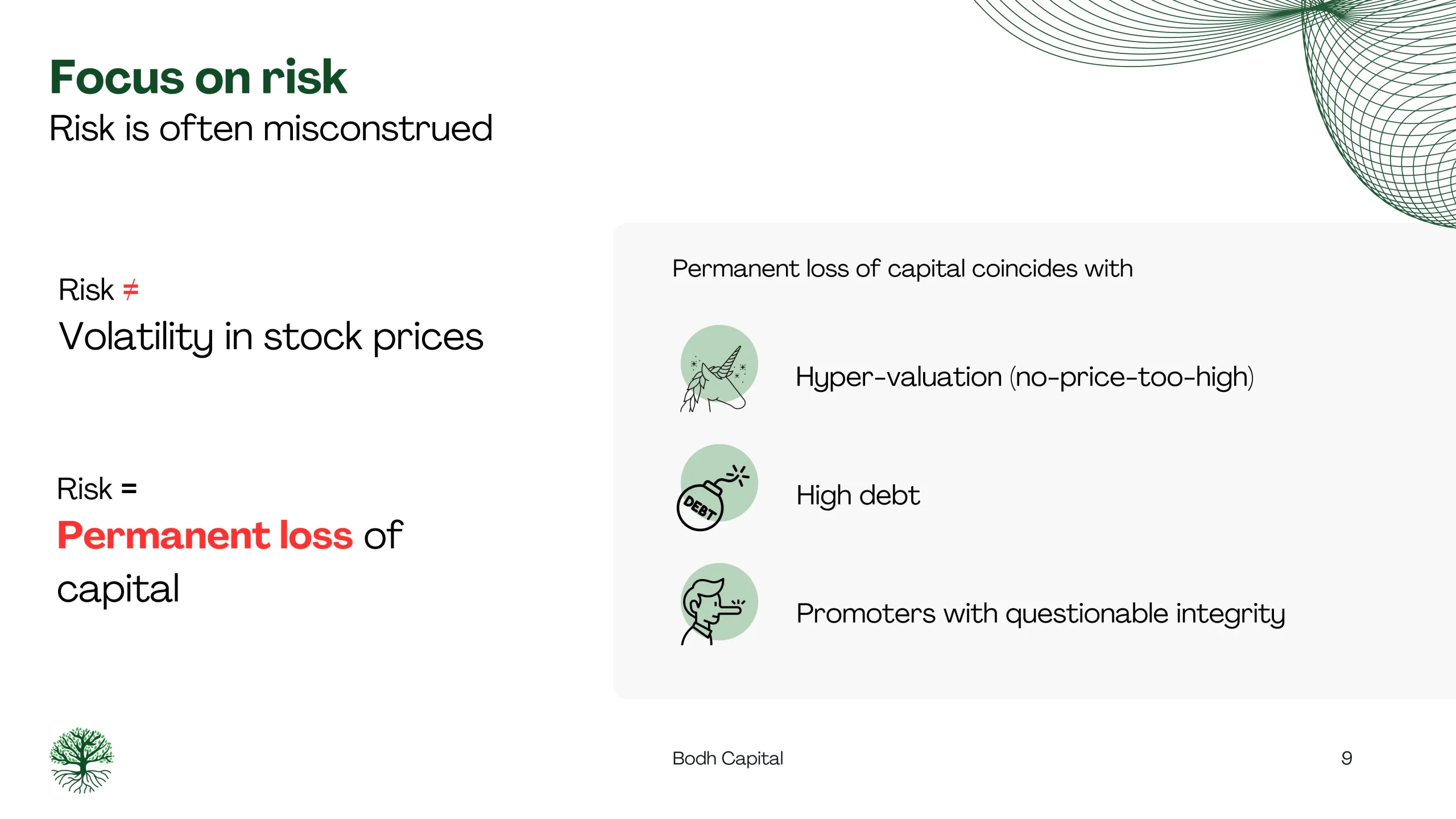

Risk ≠ Volatility In the world of investing, risk is often misunderstood. It’s not merely the volatility in stock prices that investors should be wary of, but the potential for permanent loss of capital. Investors should always keep in mind that the most important metric is not the returns achieved but the returns weighed against […]

In the realm of investing, mastering temperament is paramount. Adopting a less irrational approach involves recognizing my limitations and adhering to a disciplined process/strategy. Here’s how I try to cultivate a less irrational mindset. I don’t know Knowledge grows through subtraction, and character is honed through discipline. Staying focused on the process is key. It […]

Have you heard of the concept of “via negativa”? Via negativa is a potent concept, especially in the world of investing. This powerful philosophy emphasizes what NOT to do to improve your odds of success. In other words, instead of focusing on what to add, via negativa works by eliminating what shouldn’t be there This […]