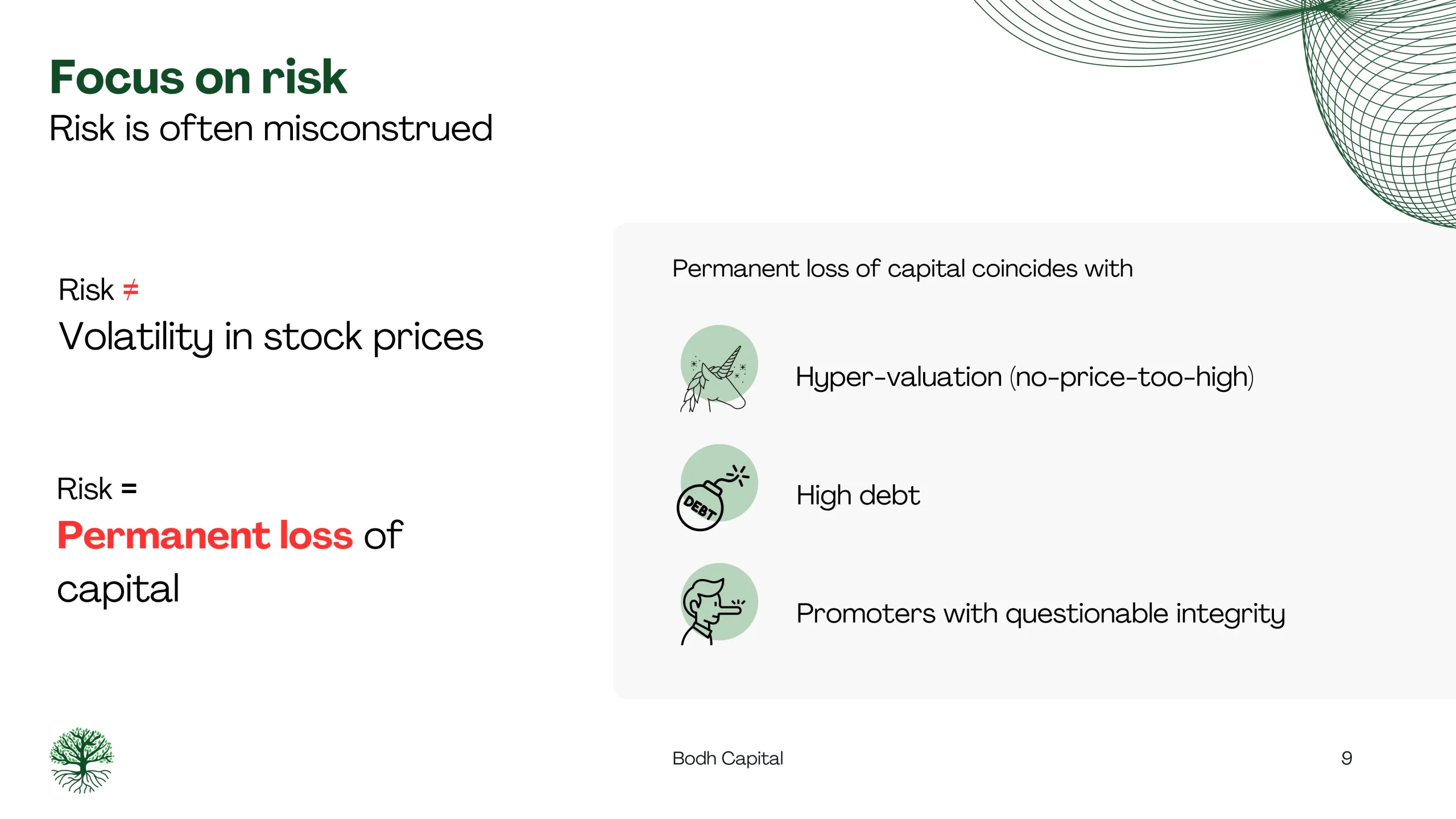

Risk ≠ Volatility

In the world of investing, risk is often misunderstood. It’s not merely the volatility in stock prices that investors should be wary of, but the potential for permanent loss of capital.

Investors should always keep in mind that the most important metric is not the returns achieved but the returns weighed against the risks incurred. Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.

Seth Klarman

This realization is crucial as permanent loss of capital often coincides with certain red flags: hyper-valuation, excessive leverage or high debt, and promoters with questionable integrity.

Via negativa

At Bodh Capital, I try to implement a via negativa approach to investing, which emphasizes avoiding risky investments rather than chasing high returns. Here’s how I implement this strategy:

1. Avoiding Added Risk

Steer clear of investments associated with added risk, such as hot IPOs, companies with sky-high valuations, and those with dubious accounting practices or questionable promoters.

2. Steering Clear of Mediocrity

Avoid investing in businesses that are difficult to understand or have poor fundamentals, as well as industries prone to disruption or where few companies are profitable.

3. Skepticism and Caution

Remain skeptical of abnormal growth and recognize that growth is mean-reverting. By being aware of recency bias, I try to avoid the trap of assuming that recent trends will continue indefinitely.

Living with risk requires a disciplined approach. Here are some key strategies we employ:

Aim for fewer losers

Instead of chasing winners, we focus on minimizing losses. We believe that winners will take care of themselves over time.

Specialization and Frameworks

My circle of competence is small. I stick to certain industries and adhere to a structured investment framework, which helps me stay focused on my objectives.

Checklists Over Intuition

We rely on checklists to identify potential risks and avoid making decisions based solely on intuition.

Thorough analysis

We thoroughly analyse the knowable factors, including financials and industry trends, to make informed investment decisions.

In a market filled with attractive but mediocre companies and bull markets that can be hard to resist, discipline and temperament are essential. By adhering to these principles and staying true to my investment philosophy, I aim to mitigate risk and achieve long-term success for my clients.

Leave a Reply